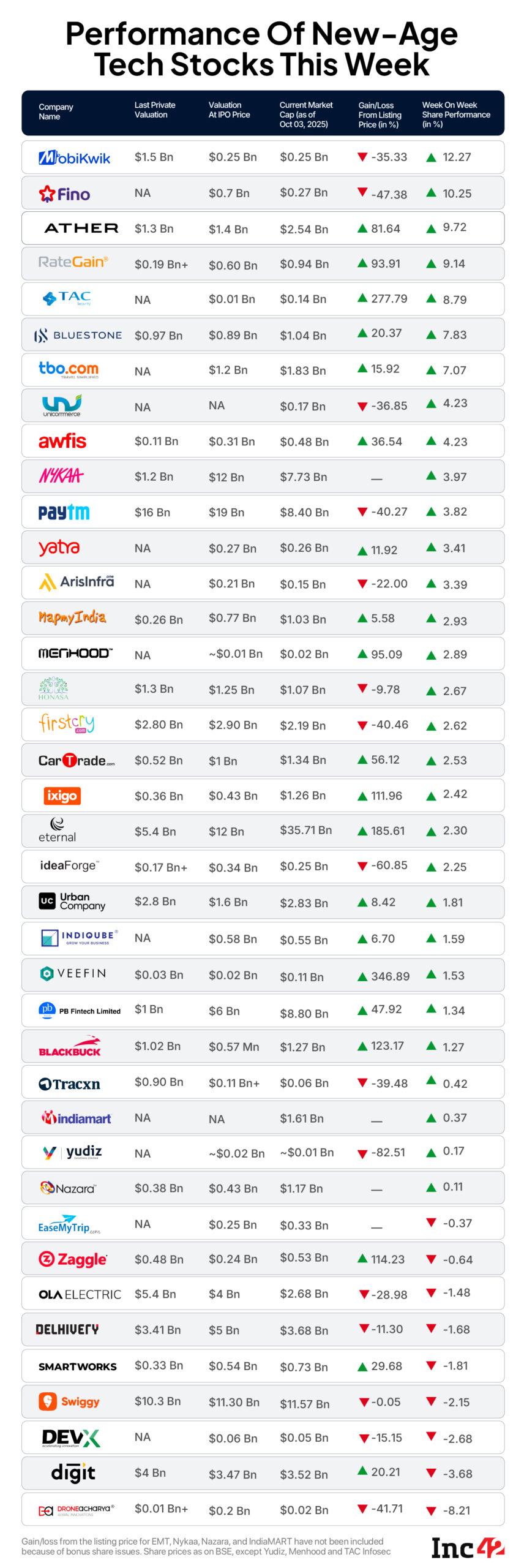

New-age tech stocks gained this week as the Indian equities market rebounded amid volatility. Thirty of the 39 new-age tech stocks under Inc42’s coverage gained in a range of 0.11% to over 12% between September 29 and October 3. With this, the cumulative market capitalisation of these companies rose to $106.59 Bn from $104.91 Bn at the end of the last week.

After witnessing a prolonged bearish investor sentiment, MobiKwik emerged as the biggest winner this week. The stock zoomed 12.27% to end the week at INR 286. Another fintech company Fino Payments Bank also maintained a bullish momentum throughout the week, rising 10.25% to end at INR 288.35.

Meanwhile, EV major Ather Energy continued its bull run, jumping 9.72% to end the week at INR 592.25. The company’s shares touched an all-time high of INR 614.75 on September 22. Ather Energy surpassed its rival Ola Electric to gain the third position in monthly electric two-wheeler registrations in September.

In the list of gainers, Deepinder Goyal-led Eternal witnessed a significant number of block deals this week. Financial services major Goldman Sachs sold Eternal shares worth INR 622.2 Cr on Wednesday (October 1) and Friday (October 4) to Bank of America (BofA) Securities. The company’s shares ended the week 2.30% higher at INR 328.45.

Recently listed Urban Company gained 1.81% to close at INR 174.55.

During the week, the hyperlocal services major was issued a show cause notice by DGGI, Mumbai Zonal Unit for alleged non-payment of CGST worth INR 51.3 Cr for the period April 2021 to March 2025.

The company said it will respond to the notice within the prescribed timeline.

Meanwhile, insurtech company Go Digit also received a couple of demand notices in the last week of September. The company received the two show cause notices from GST authorities in Delhi and Mumbai for a total GST demand of INR 26.65 Cr. Its shares declined 3.68% this week to end at INR 337.90.

Go Digit was the second biggest loser among the nine stocks which fell in a range of 0.37% to over 8% this week.

While dronetech company DroneAcharya topped the list, shares of EaseMyTrip fell to a fresh all-time low this week.

After falling to an all-time low of INR 7.99 on Monday (September 29), the online travel aggregator’s shares ended the week at INR 8.15. This marked a 0.37% decline from last week.

Now, let’s take a look at what happened in the broader market.

RBI’s Dovish Stance Lifts MarketsThe Indian equities market ended the holiday-shortened week on a positive note, rebounding from recent losses amid broad-based buying and cautious optimism following the RBI’s policy decision. The Nifty 50 gained 0.97% to close at 24,894.25, while the Sensex rose 1% to settle at 81,207.17.

According to Ajit Mishra, SVP of Research at Religare Broking Ltd, sentiment improved significantly after the RBI’s monetary policy committee (MPC) meeting outcome on Wednesday (October 1), which supported domestic equities after last week’s sell-off.

The MPC kept the repo rate unchanged at 5.5% for the second consecutive meeting, while revising the FY26 GDP growth projection upward to 6.8% and lowering its inflation forecast. The central bank also announced a number of measures aimed at boosting credit flow and strengthening capital markets.

Meanwhile, domestic macro data was mixed – industrial output growth slowed to 4% in August, while the manufacturing PMI eased to 57.7 in September. GST collections, however, rose 9.1% year-on-year to INR 1.89 Lakh Cr in September.

With the rally this week, mid-cap and small-cap indices climbed around 2%, reflecting improving risk appetite despite persistent FII outflows. VK Vijayakumar, chief investment strategist at Geojit Investments, noted that sustained FII selling continued in September, with net offloading of INR 27,163 Cr through exchanges.

“However, FIIs bought INR 3,278 Cr in the primary market during the same period. Total FII selling in 2025 now stands at INR 1.98 Lakh Cr. Higher valuations in India and cheaper alternatives abroad have driven this strategy, but with the valuation gap narrowing and Indian earnings likely to improve in FY27, FII selling is expected to slow going forward,” he added.

Looking ahead, the coming week will be pivotal as Q2 FY26 earnings season begins, with IT bellwether TCS scheduled to announce results on October 9. On the macroeconomic front, services and composite PMI releases, along with banking sector loan and deposit data, will be closely watched.

Globally, US macroeconomic updates, including FOMC minutes, jobless claims, and consumer sentiment, will influence market sentiment, particularly amid the ongoing government shutdown.

Primary market activity is also set to remain strong, with large IPOs from Tata Capital and LG Electronics lined up.

However, the IPOs of new-age tech companies saw muted response this week. While Zappfesh had to extend its IPO timelineand lower its price band after undersubscription, WeWork India’s IPO was only subscribed a mere 4% on day 1.

Now, let’s take a look at the performance of MobiKwik and DroneAcharya.

MobiKwik Regains Some MomentumMobiKwik emerged as the top gainer this week, but the stock is still down 35.33% from its listing price.

About five months after venturing into the NBFC space, MobiKwik’s boardapproved an investment of INR 9.99 Cr in its subsidiary, Mobikwik Financial Services Pvt Ltd (MFSPL), this week.

The investment, to be made by October 10, will help MFSPL operate as an NBFC and undertake leasing and hire-purchase deals for machinery, vehicles, ships, aircraft, factories, and real estate.

MobiKwik set up MFSPL in April with INR 1 Lakh in paid-up capital. Currently, the fintech partners with banks and NBFCs for providing loans. Bringing lending in-house could add a new revenue stream and expand cross-selling opportunities.

On the financial front, the company has been under pressure over the past few quarters. After reporting losses throughout FY25, MobiKwik posted a net loss of INR 41.9 Cr in Q1 FY26, over 6X of INR 6.6 Cr in Q1 FY25. Revenue also fell 21% to INR 271.4 Cr.

CFO Upasana Taku attributed the decline to disruptions in credit distribution and regulatory changes in P2P lending, which forced the shutdown of products like its BNPL platform Zip.

DroneAcharya Slips After H2 FY25 LossDronetech company DroneAcharya was the biggest loser this week, with its shares dropping 8.21% to close at INR 337.90 following the release of its H2 FY25 results. The company reported anet loss of INR 15.1 Cr in the second half of FY25 as against a profit of INR 2.2 Cr in H2 FY24. In H1 FY25, DroneAcharya had posted a net profit of INR 1.6 Cr.

The loss was largely due to a sharp decline in operating revenue in H2, which fell 47% YoY to INR 7.6 Cr. Sequentially, revenue crashed 72% from INR 26.9 Cr.

For the full fiscal FY25, the company recorded a net loss of INR 13.5 Cr as against a profit of INR 6.2 Cr in FY24. Operating revenue for the year stood at INR 34.5 Cr, down 1.9% from INR 35.2 Cr.

DroneAcharya attributed the delay in H2 disclosure to resource constraints and extended internal audits, which led to a BSE fine of INR 1.5 Lakh. The company also received a SEBI show cause notice in May. The matter is under examination and financial implications, if any, are yet to be determined.

In FY25, the company made a provision of INR 13 Cr for doubtful debts and advances, while trade receivables remained high at INR 25.3 Cr. Operating cash flow turned negative at INR 7.1 Cr, reflecting ongoing liquidity pressures.

The post New-Age Tech Stocks Regain Momentum This Week, MobiKwik Biggest Winner appeared first on Inc42 Media.

You may also like

Give Jarange AK-47 to eliminate OBC in one go, says Vijay Wadettiwar on Maratha quota

Kantara Chapter 1 Box Office: Rishab Shetty's Film Eyes ₹300 Crore Extended Opening Weekend Globally After Strong Day 3 Collection

11 children dead in MP: Doctor who prescribed cough syrup arrested; TN-based manufacturing company booked

Gadchiroli Bombing Case: Charges Framed Against Four Accused In 2019 Jambhulkheda Naxalite Blast

Sausage and mash will taste better if you add 1 ingredient to gravy